-

Italien

Managing Lawsuit Risk: A Budgeting Framework for Legal Costs

19 Februar 2026

- Verträge

- Rechtsstreitigkeiten

Summary: The challenge with preventive legal work is that it’s difficult to justify in the corporate budget—especially in organizations lacking a strong culture of risk prevention and mitigation. This article offers a practical solution: applying a “value-at-risk” approach helps leadership understand why every euro spent on preventive legal assessment can prevent multiple euros in litigation costs, sanctions, business disruption, and avoidable losses. A simple Return on Legal (ROL) metric makes that value tangible by calculating avoided costs from past disputes and modeling the financial effects of potential future lawsuits.

Why Legal Risk Management Needs a Financial Metric

Most companies already invest in preparedness—just not consistently in legal. They run security drills, insure assets, addres civil and product liability, test business continuity plans, and model financial risk. However, legal risk is often overlooked and, when considered, remains in the “qualitative” bucket: high/medium/low, red/amber/green, or a list of concerns in a memo.

That becomes a problem when decisions are made. Budgets are approved in numbers, not adjectives. If companies want legal preparedness to be funded like business preparedness, they need a framework that decision-makers are already familiar with. That’s where applying a value-at-risk approach helps.

Legal Risk as Value-at-Risk

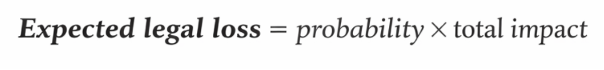

Value-at-Risk in finance asks a simple question: how severe could the downside be, and how often might it happen? Legal risk can be approached in a similar way by considering two factors: the likelihood of an event (such as a claim, dispute, investigation, enforcement action, fine, lawsuit, or class action) and the impact if it occurs. Things can get very complicated, but for the sake of this article, a very simplified way to express it for a single- well defined, loss event might be:

“Total impact” is often underestimated when assessing legal risk. Direct legal costs are just one part of the picture. A dispute can consume leadership time, divert key teams from revenue-generating work, slow down delivery or product launches, damage supplier relationships, and cause customer hesitation. In other words, legal risk is often an operational risk with legal triggers.

Therefore, we should consider that legal risk rarely appears as a „fixed impact if it happens,“ and the expected risk value often accumulates through the correlation of different factors. For example, one investigation can trigger follow-on lawsuits, a license can be revoked, a class-action can start, or enforcement can occur across multiple jurisdictions. If we want to account for this scenario (“how severe could the downside be and how frequently”), then the framework should involve a loss distribution over a period, which might look like this.

Expected legal loss (per period) = expected frequency x expected severity

This isn’t about finding the perfect formula. It’s about making legal exposure comparable to other risk areas where investment decisions are routinely supported with quantified downside.

Introducing Return on Legal (ROL)

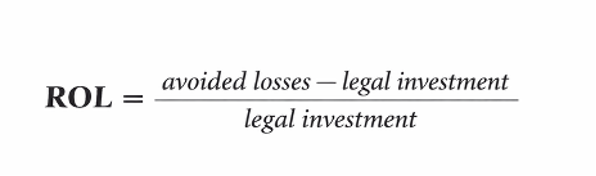

Preventive legal work often goes unnoticed when it succeeds. When a contract dispute is avoided or a claim is settled early, there is no dramatic event—only the absence of damage. This is exactly why preventive advisory is often seen as a cost during budgeting: it appears more like an expense than an investment. A Return on Legal (ROL) metric addresses that gap by translating prevention into business results. In practical terms, ROL shows how much cost and disruption you save for every euro/dollar invested in legal risk assessment and prevention.

A definition could be expressed as follows:

When considering avoided losses, one should factor in a projection over a period of time (e.g., 3 years), the probability of a claim (e.g., 10%), and a baseline frequency of disputes. From there, it’s easy to get lost in complex calculations that take many variables into account; my point is not to achieve perfect precision but to make a credible, quantifiable estimate that supports better decisions in legal risk assessment and budgeting.

Measuring ROL: Retrospective vs. Forward-Looking

A convincing ROL approach combines what companies already know from experience with what can reasonably be modeled going forward.

First, there is the backward-looking perspective: assessing costs based on past litigation and disputes. Most companies have at least a few cases that can serve as reference points. The task is to identify where earlier legal intervention could have minimized the likelihood of escalation or the severity once a matter arose. This could be something as simple as improved clauses that prevent a dispute from escalating, earlier involvement of external counsel leading to quicker settlements on better terms, or custom dispute resolution clauses that reduce discovery burdens and strengthen the negotiating position.

To estimate backward-looking ROL without overclaiming, we can set a baseline for “what happened” or what usually occurs when that type of risk materializes without intervention. Then, compare that baseline with the results achievable when preventive measures are in place. There’s no need to pretend we can calculate the exact euro value to the last cent. What we require is a defensible range, based on actual costs (fees, settlement amounts, internal time) and business impacts that can be reasonably estimated (delayed launches, downtime, diverted capacity).

Second, there is the forward-looking perspective: forecasting the financial impact of potential future lawsuits. This is where the value-at-risk approach proves powerful. Decision makers identify the most relevant exposure types for their business and develop scenarios for each—typically best case, base case, and worst case—then assign probability ranges. The simulation becomes more meaningful when they consider how specific preventive measures influence the model. Some actions decrease probability (for example, compliance controls and training). Others lessen impact (such as better contracts, liability limitation clauses, response protocols).

Many do both. In the end, leadership gets a quantified story: this prevention program lowers expected annual legal losses and reduces exposure to litigation-related damages. This mirrors the decision-making approach used in other preparedness and risk-management programs.

Let’s make an example of how ROL works

Imagine a business line where disputes often come from contract ambiguity and inconsistent negotiation practices. In the past, the company occasionally faced lawsuits or arbitration, but more frequently it dealt with costly „pre-litigation” escalations that still took months and used up a lot of internal resources.

A preventive program—featuring updated templates, negotiation playbooks, and targeted training—incurs a clear cost. From a value-at-risk perspective, you compare that expense to the expected loss without the program over a certain period: not only external fees and settlements but also the estimated operational impact of ongoing disputes. If the program decreases how often disputes escalate and accelerates resolution times, the avoided losses can quickly outweigh the preventive costs. That difference reflects what ROL captures in a way that leadership can act on.

ROL Implementation: Keep It Lean and Actionable

ROL does not require a perfect dataset on day one. What it needs is consistent categorization, conservative assumptions, and a commitment to improve the model over time. A practical starting point is to gather three streams of information: historical disputes and their total costs; recurring risk hotspots (such as contracting patterns, product or market launches, HR issues, data/privacy exposure, supplier disputes, client disputes); and operational impact estimates that the business already uses in other contexts (like cost per hour of downtime, cost of delays, internal resource allocation).

A practical starting point is to pull together three streams of information:

- historical disputes and their total cost;

- recurring risk hotspots (contracting patterns, product or market launches, HR issues, data/privacy exposure, supplier disputes, clients disputes); and

- operational impact estimates that the business already uses in other contexts (cost per hour of downtime, cost of delays, internal resource allocation).

Where data is uncertain, ranges can be helpful. Managers can assign confidence levels and keep the model honest by using conservative estimates. Over time, the ROL model becomes more accurate as the company consistently tracks legal events and as prevention initiatives develop. The most important mindset shift is to treat legal as you would other risk functions: as a measurable way to minimize downside, not just a reactive cost center.

Turning ROL Into a Decision Tool

Once legal risk exposure can be expressed in value-at-risk terms, companies can prioritize legal work using the same logic as other investments: risk reduction per euro spent. This shifts the conversation from “Should we spend on prevention?” to “Where do we get the biggest reduction in expected loss and tail risk?” ROL also improves alignment with business teams. Instead of speaking in purely legal categories, it is possible to connect legal work to operational outcomes—fewer delays, fewer escalations, faster resolution, reduced management distraction, greater predictability in commercial relationships. Over time, this fosters a healthier operating rhythm: legal risk reviews transition from being ad hoc to becoming a routine part of preparedness, similar to finance risk reviews or security protocols assessments.

Conclusion

Applying a value-at-risk perspective to preparedness reveals legal risk in the language corporate leadership already uses to allocate resources. A Return on Legal (ROL) metric then makes preventive legal advice concrete by turning avoided costs and operational losses into measurable value. By combining evidence from past disputes with future-focused simulations of potential lawsuits, companies can build a credible, data-driven argument that every euro invested in legal risk assessment can prevent multiple euros in losses—and that prevention is not just a “nice to have,” but a vital part of operational resilience.